IPE Conference & Awards 2020

Keynote Address: A Viable Pension System in a Post-COVID Environment – Paul Owens

The IPE (Investments and Pensions Europe) Conference & Awards 2020 is the largest virtual gathering of European pension funds including more than 40 world class speakers, over 20 sessions across three days, culminating each day in the presentation of the coveted IPE Awards 2020.

For the video version follow this link

You can also download a pdf copy of my speech here.

Text of the Speech

Good afternoon to all. It is too bad that we are not able to participate in this conference in person in Madrid.

During my 40 year career in the pension and investment business, 31 years were spent on as a plan sponsor or trustee and 9 as a pension regulator for the Province of Alberta, Canada. Therefore, most of my comments will be from the plan sponsor perspective. For the actuaries in the audience, these 31 years translate to 77.5% of my career. Finally, the following comments represent my own personal views and not necessarily those of any current or former employer.

To say the least, 2020 has been a year like no other. A year ago, who would have predicted:

- A global pandemic in the form of COVID 19 – a pandemic that is the worst one that the world has experienced in the last 100 years

- Record stock market returns early in the year followed by record losses only to see an almost full recovery.

- A massive displacement of work arrangements for millions that were used to going to work at an office or store

- Some industries in freefall with limited prospects for an immediate recovery, and, finally

- Fiscal and monetary relief that makes what we all experienced in 2008 seem frugal, responsible and disciplined.

My talk to you today is to identify some key issues that pension plans will need to address in a Post- COVID environment.

I have chosen 5 perspectives which I believe will shape our pension environment for the foreseeable future:

1. Pension membership eligibility

2. Plan design

3. Liability and investment management

4. Governance

5. The impact of Environmental, Social and Governance factors or ESG on pension plans and their investment funds.

- We now turn to point 1 : Pension membership eligibility.

Historically, in most cases, people who joined pension plans tended to show up at the location where they were regularly employed and where hours and earnings could be easily tracked.

With COVID, the employment world has changed:

- As many employers have shut down, either permanently or temporarily, many employees are out of work. A number of these jobs will not return at all. For those who were members of pension plans, plan membership numbers and hours worked decreased resulting in a drop in pensionable service.

- For people who now work from home, while their pension membership should continue in most cases, for how long will employers continue to classify them as regular employees eligible for pension membership?

- The issue that concerns me most is what happens when these new stay at homers resign or retire?

Will they be replaced at all?

And if they are, will it be on a contract basis and probably not eligible for pension membership?

The first question that I leave with you to ponder is:

QUESTION 1: Will your new stay at home employees be eligible to join your plan?

2. Plan Design

The first question leads to the second. With a change in your workforce, I suggest you need to address the following:

1. To what extent do you feel an obligation to provide a pension plan at all for your employees?

I suggest this is the time for plan sponsors to revisit their Compensation or Total Rewards Philosophy.

- Will your plan be for all employees, or only those who work at your location, thus excluding those who work at home if their employment status changes to a contract basis?

- Who should bear the funding risk – the employer, the employee, or should it be shared between both?

- Do you have different designs for different groups, such as Defined Benefit or DB for office workers and Defined Contribution or DC for home workers?

- Keep in mind that your existing plan was designed for employees who spent a large portion of their whole career with you. For most of you, that is probably no longer the case and is a total relook at plan design now appropriate?

The second question for you is:

QUESTION 2: Do you:

- Want to offer a pension plan?

- If so, is everyone eligible?

- Do you differentiate between home and office workers and regular employees and contract employees?

- Is the plan the same for everyone or does it vary by group and type?

- Who bears the risks: you, them or both?

- Liability and Asset Management

Assuming you still plan on offering a pension plan, question 3 deals with liability and asset management.

- In a DC plan, the employer’s obligation is to contribute a pre-defined amount. There is no direct obligation that must be funded as in a DB plan.

However, I believe there is an implicit objective in that the employer and employee contributions should be sufficient to provide a reasonable lifetime income stream to a career employee. The definition of reasonable will vary based on the views of the employer, or employer and the employee.

- To make this work, regardless of the amount of contributions, the plan member’s risk tolerance must be determined where the plan member determines the asset mix.

- This means extensive communications so that the member understands that higher returns come, and only come, with higher risk. As one of my former trustees advised me: “You can either sleep well or you can eat well”. I have a fear that many plan members left to their own devices have been too conservative in their investment choices.

- With a DC plan, there is always the fact that the ex-member will either outlive their pension assets or leave money on the table.

- This is why I am becoming increasingly attracted to a shared risk arrangement where mortality and investment risks are pooled. These target benefit plans have worked well in the multi-employer environment that I am familiar with. A U. K. example is the plan or scheme for the Royal Mail – the British Postal system. The benefit is aspirational, has a high probability of being reached and has mechanisms to raise or lower it based on the funded level and investment returns.

Turning to DB plans, funding the benefit promise is particularly challenging for the following reasons.

- The biggest problem is low interest rates which increase the liabilities significantly because the low interest rates directly result in low discount rates, unless the actuary uses an aggressive equity risk premium.

- This in turn leads to increasing the risk profile of the plan by investing in riskier assets to generate the required returns.

- A major challenge facing all pension funds is to what extent are we borrowing from future returns given the low interest rate environment and massive infusion of quantitative easing.

In addition, has this ongoing low interest rate environment permanently distorted the efficient allocation of capital?

To what extent will previous investment models and their allocation to various asset classes be relevant in tomorrow’s environment.

- Turning from the general to the specific, the asset class that I feel will undergo the biggest change over the next decade is real estate.

Real estate has historically been comprised of 4 sectors:

- Multi- family

- Retail

- Industrial

- Commercial office.

Over the past few years with the exponential growth of on-line shopping, the retail sector has been suffering. The industrial sector has seen a change to increasing emphasis on warehouse facilities to deal with increased distribution arising from on-line shopping.

Now with work from home increasing in scope, the need for downtown office space has plummeted. Some real estate managers have countered that the need for social distancing will increase the size of cubicles, but I doubt this will counter the fact that more employees will never return to their office either because they will continue to work from home or their jobs will have disappeared.

This move was in play before COVID as many firms were already moving from offices and cubicles to open office structures and hoteling. COVID has just accelerated this trend.

Plans with existing real estate portfolios will have a long recovery ahead of them. For plans looking to get into real estate, this is an opportune time to get in at the bottom. I suggest plans look at managers who are trying to build a new portfolio from the beginning as opposed to buy an existing portfolio simply because it is cheap – remember, it is cheap for a reason.

The specific questions arising from this are:

Question 3:

- What is your strategy to deal with ongoing low interest rates?

- To what extent are you going to be comfortable with increased risk to go after higher returns along with higher volatility?

- How much risk are you prepared to take?

- How much time do you have to pay off the losses resulting from market downturns as a result of the risk you have taken?

- Should plans, whether DB or DC. Consider moving to some type of shared risk arrangement?

- Should you take another look at real estate and either buy, sell or reposition your portfolio?

4. Governance

In Question 4, we turn to Governance

Governance historically has focused on corporate governance, generally at the Board of Directors level. In Canada at least it moved into the pension arena in 1995 as a result of a famous court case, involving Enfield Corporation Limited.

Pension governance is now part of the pension plan mainstream along with plan design, funding and investments.

While a lot of time, effort and fund money has already been spent on improving pension governance prior to COVID, a lot more should be spent post COVID on governance.

Why? And how will this change going forward?

From my experience, governance activities in the past have concentrated on developing and adhering to processes to minimize or mitigate risk and liability exposure for the plan sponsor or board of trustees.

While this has been welcome, it has in my view only scratched the surface. I do believe based on observation that Europe is ahead of North America in this regard. Thus, my comments may be less applicable to a European audience.

There are 3 main governance issues that remain to be addressed. COVID has only accelerated the urgency.

- The first is the quality and skill sets that corporate boards or boards of trustees, collectively, the pension governors of the plan, should have as it relates to pension matters.

This includes a mix that the entity should have, and I say mix as the skills are beyond the scope of any one individual.

The pension governors in the aggregate should possess sufficient competence in the following areas:

- Funding obligations

- Risk tolerance and mitigation strategies

- Investment management and portfolio structure

- Plan design

- Reputational risk

- Plan administration and member communications

- Accounting requirements and interpretation of audited financial statements

- Actuarial methods and valuation statements

The board does not to be an expert in every facet but needs to have sufficient understanding to ask the appropriate questions of their internal managers and external advisors.

To avoid micro-managing, the board needs to adopt the governance mantra of “nose in, fingers out”

- The second challenge is to appoint those who have the required skills as opposed to simply appointing members because they represent a particular constituency. This is particularly challenging in joint employer-employee boards where both groups make appointments based on their affiliation with the appointing organization as opposed to looking at the skill sets required. Telling long standing board members that they are not eligible for reappointment because they do not possess the newly required skills is a difficult thing to do and is not always handled well.

The only workable alternative in my view is, instead of appointing those with the required skill sets to the board, is to delegate decision making, with proper oversight, to those that have the skills.

- The most challenging responsibility as opposed to task for those charged with governance over-sight for DB plans is ensuring these plans are properly funded over the long term.

Historically, plans could weather the ups and downs of market volatility and remain sufficiently well- funded over a market cycle.

But that was when we had normal interest rates that produced affordable liabilities and reasonable asset returns.

With policy induced interest rates close to zero, the entire funding regime has been distorted – certainly for the short term and probably for the longer term as well.

The consequences of zero interest rates are reaching out on the risk spectrum for yield which in turn results in greater volatility.

This leads back to the questions asked previously – how much are you prepared to lose and what is your time frame to recover your losses? The answers will be specific to each plan and every plan will have to come up with its own answer.

This is a serious strategic issue that will only start to be addressed by the current cohort of pension governors. Your successors will have to continue the journey and they will not appreciate it if your efforts in defining your strategy are merely cursory.

Yes, the buck, or pound or euro does stop with you.

The question I leave you with has 3 parts:

- What skills do your pension governors in the aggregate need to possess?

- How do you ensure your board appoints the right people with the right skills?

- What is your strategy to ensure your fund is sufficiently funded in a low interest rate environment?

5. ESG

The last item I wish to touch on is the rapidly growing subject of Environmental, Social and Governance factors or ESG and their impact on pension plans.

One of the key starting points for this movement was the 1985 case in the United Kingdom of Cowan vs. Scargill which ruled that the primary fiduciary duty of the trustees was the financial interests of the beneficiaries.

The pension industry has come a long way in the last 35 years in terms of its response to ESG factors. It is no surprise to this audience that ESG has been more rapidly embraced in Europe than in the United States. Canada as usual is somewhere between the 2.

However, virtually every day I read in the pension media that more and more pension plans and their money managers are embracing ESG – either in whole or in part.

ESG has taken off the same way governance did 20-25 years ago.

Plans and their service providers who do not visibly come on board risk being left behind. Members and governments are increasingly demanding more from plans themselves and plans are demanding more from their money managers.

While this subject can take up many speeches, I believe this issue of ESG will dominate the pension industry going forward in a post COVID environment in a vein similar to the determination of a plan’s risk tolerance.

Peer pressure and regulatory requirements will force pension plans to at least deal with ESG as an issue.

The main issue that plans will have to consider is to decide whether:

1. To embrace ESG only as a tool to mitigate risk from an investment perspective, or

- Use ESG as a broader tool for a pension plan to effect social change.

As a prominent Canadian pension lawyer has stated: “It’s a question of value vs. values”

I certainly see the first option being a minimum. There appears to be a growing momentum to accept if not embrace the second option and I can see that becoming more prevalent in the coming years.

The challenge for pension plans is to decide where they lie on this spectrum, as I do not see it entirely as an “either/or” proposition.

For plans that decide to embrace ESG, the question of how becomes critical. From a pure investment perspective there are many approaches:

- Disengage by selling investments that do not meet your ESG criteria,

- Invest only in companies that meet your ESG criteria, and

- Become an active investor by voting your proxies or directly engaging with management

The second and last point I would like to focus on is the Environmental or E part of ESG, specifically Climate Change.

I saved my 2 slides to the end.

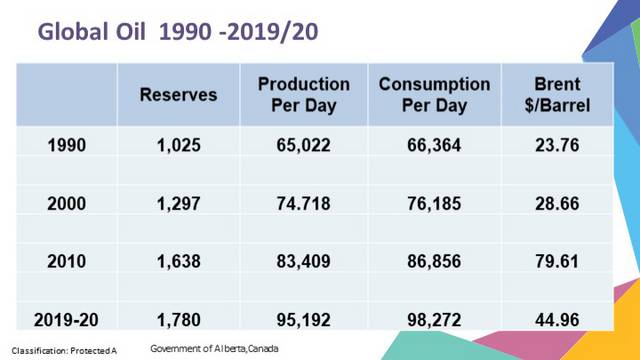

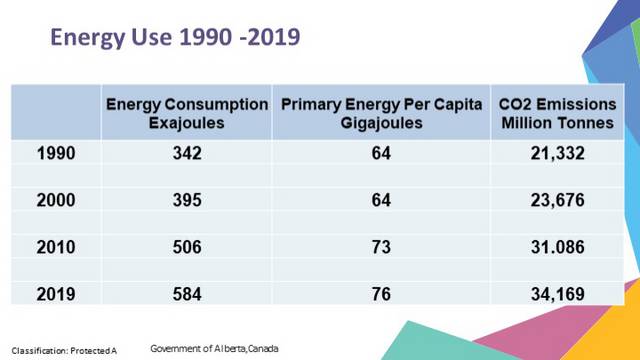

The first looks at oil production and the second looks at energy consumption and carbon dioxide or CO2 emissions.

There are 3 key messages:

- From Slide 1:

- In spite of increasing production, oil reserves keep on increasing.

- From Slide 2:

- In spite of increased efficiency, or maybe because of it, energy consumption continues to increase, and

- Most importantly, CO2 emissions continue to escalate.

The question I pose to you is:

Do pension plans have a role to play in Climate Change, particularly in reducing CO2 emissions?

Some may argue that this is more of a society than a pension issue and pension plans should only be involved to the extent to mitigate investment risk.

Let me leave you with an alternative and possibly controversial option:

Pension plans through engagement and direct investment must tackle Climate Change, because if they do not, we quite likely will not have a habitable planet for society in general and our plan members in particular. I believe a case can be made that plans’ fiduciary obligations to their members extend to helping ensure we provide them with a world in which they can breathe and live.

So, my final 3-part question to you is:

- Is ESG critical to your plan, and, if so, do you see ESG being interpreted in a narrow or broad way?

- Do pension plans have a direct responsibility in mitigating climate change?

- What approach will you use to incorporate ESG in your investment and engagement activities?

So, to wrap things up, I have raised 5 issues that I believe will influence our pension plans in a post COVID environment:

- Membership eligibility

- Plan design

- Liability and asset management

- Governance

- ESG issues

While I have views on each of these, I do not have the answers. Rather I have posed these as questions for each of us to consider as we structure and manage our plans to adapt to a challenging future.

I appreciate the opportunity to talk to you this afternoon and I believe we now have some time for some questions.

Leave a Reply